The world of finance evolves at a breakneck speed. So, financial companies need to curate innovative strategies to stand out in the digital landscape. Harnessing the power of financial content marketing can be the difference maker in achieving that.

In this guide, we’ll explore the invaluable role that content marketing plays in the financial industry.

We’ll discuss how content marketing strategies cater to financial firms’ unique needs. Plus, highlight ways to optimize and stand out in the crowded financial space. Then, we’ll cover the pitfalls to avoid and predict trends for the future.

Understanding Financial Content Marketing Today

Historically, businesses have centered their marketing strategies around showcasing the quality of their product or service. But in this day and age, it’s all about the customer. In a recent study, customer experience ranked first as businesses’ number one priority for the next five years.

Here are some of the other stats from that study:

- 86 percent of buyers are willing to pay more for a great customer experience.

- 81 percent of organizations cite CX as a competitive differentiator.

- 49 percent of buyers have made impulse purchases after receiving a more personalized customer experience.

With this shift towards customer-centricity, a high-quality content marketing strategy has become more invaluable than ever.

Financial content marketing crafts and distributes content designed to magnetize, captivate, and convert a specific target audience. It’s one of the most essential tools to maximize your reach and ROI.

In the past, traditional marketing strategies have often employed a “hard sell” approach. But that direct and pressured approach has become less and less effective.

Content marketing flips the narrative.

It’s no longer about pitching a product incessantly. Instead, it’s about cultivating trust with your target audience by showing you understand their challenges and then providing them with solutions.

At its essence, financial content marketing delivers value upfront. It meets your audience where they are. Then it guides them to where they want to be. It’s not about telling your audience why they should choose you. It’s about demonstrating that “why” through content that speaks directly to their needs and interests.

Why content marketing matters in finance

These days, transparency is the new currency. Trust has become the backbone of curating successful long-term customer loyalty.

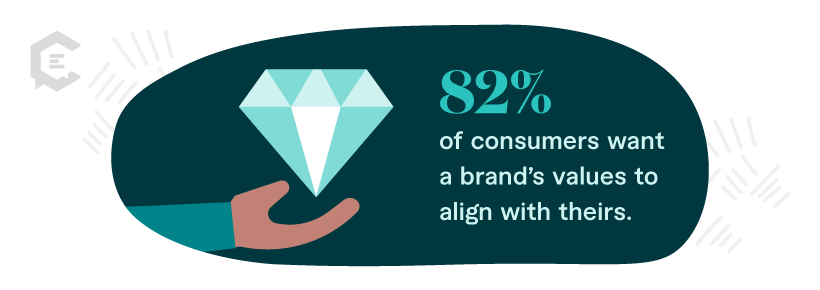

A 2023 study showed that 82 percent of consumers want a brand’s values to align with theirs. 75 percent would part ways with a company over conflicting values. And as millennials and Gen-Z age, that number may only get bigger.

That customer desire for trust is especially true with money management and financial planning. People have a lot of emotions tied around money. Your financial company must tap into those feelings to engage them effectively. That means building an awareness around your brand that showcases honesty and transparency.

But building that awareness can be a challenge. The financial market is a crowded one. Today’s consumers do much research before engaging with a financial service provider. Additionally, they can choose a provider from anywhere in an expanded digital world. A high-level content strategy can be the deciding factor.

Your financial content marketing strategy is your direct connection with your target audience.

A strong and impactful strategy establishes your company as more than just another finance provider. It exemplifies your business as a financially worth choosing and a brand worth remembering. By sharing valuable insights that help consumers navigate their financial journey, you’ll foster customer relationships that can last a lifetime.

Unique challenges and opportunities

Financial content marketing isn’t without its challenges and pitfalls.

One of the biggest is distilling complex financial concepts into digestible content that resonates. It won’t matter if you have the best services in the entire industry. If your audience doesn’t understand what you’re selling, they won’t buy.

There’s also the issue of regulatory compliance. In the financial industry, every piece of content must adhere to strict financial advertising guidelines.

But you can turn these challenges into opportunities.

Those intricate financial concepts? They’re an opportunity to show your company’s expertise.

Breaking down intricate financial concepts into accessible content reassures your audience. They know that you can handle the complexity of financial planning and guide their financial journey. And following those strict guidelines strengthens your brand’s credibility and integrity.

Exploring Successful Content Marketing Strategies for Finance

Successful content strategies aren’t just about creating content.

They also ensure that content is accurate to your mission and promoted effectively. Most of all, they’re about crafting content harmoniously to serve your brand’s overall mission and objectives.

With that in mind, let’s dive into some strategies that have proven successful.

Tailoring content to your audience

In financial content marketing, one strategy rises above the rest: understanding your audience. It’s the main key to unlocking customer engagement.

That means knowing:

- Who they are

- What they need

- How they behave

- What their pain points are

Having a complete understanding of your target audience is your foundation. Once you understand them, you can tailor your financial content ideation and creation to capture their attention, emotionally resonate, and drive conversions.

Audience segmentation

One of the best ways to gain that understanding is through audience segmentation.

Audience segmentation means dividing your audience into groups based on certain characteristics. Those groups can serve as a template to build buyer personas that help you pinpoint exactly who you’re targeting.

Some characteristics used are:

- Age

- Income

- Location

- Behavior

- Occupation

- Marital Status

- Investment goals

- Financial knowledge

Once you have them segmented, you can tailor content to speak specifically to each group.

An important note though: tailoring your content isn’t a one-time thing. Your audience is constantly evolving. That means you need to evolve with them.

It’s essential to regularly review your content strategy using engagement metrics and audience feedback. Once you collect that data, you can adjust your content as needed. That way, you ensure it keeps hitting the mark and converting.

Here are two prime examples of areas you can focus your financial content strategy:

Financial education content

Understanding the world of finance can feel challenging to the majority of consumers. They can find themselves overwhelmed by all the complicated terms and concepts.

One of the most successful strategies to deploy to solve this problem is financial education content. It’s a perfect opportunity for financial companies. You can create content that demystifies those complex concepts and establishes a connection. This is especially effective if you’re in the personal finance education space.

Because at its heart, content marketing strategy is about offering value.

By crafting content that simplifies complex financial jargon into easily digestible bites, you provide an extremely valuable service to your audience. You give them tools and expertise while positioning your brand as a trusted, consumer-focused source of insight.

The types of financial content can take all sorts of forms from:

- Blog posts that articulate and explain basic financial concepts.

- Infographics that break down complex data and processes into easy-to-understand visuals.

- Ebooks as downloadable in-depth guides.

- Instructional videos or explainer animations that illustrate concepts in a fun and engaging way.

- Social media posts that offer quick tips and insights.

- Newsletters that inform and engage through consistent connection.

- Case studies that explore practical, real-world examples of successful strategies.

- Comprehensive webinars that deep-dive into investment strategies.

- Podcasts that educate your audience as they go about their day.

- Whitepapers that offer data-driven, in-depth insights and establish your brand as a thought leader.

Industry news and insights

Another super effective way to keep your audience engaged is updating them on industry news and trends.

First, it’s a great value add to help your audience make the most informed financial decisions. Second, it shows your company is at the forefront of the current trends in the financial market.

To make this content more engaging, go beyond just giving updates.

Add your own analysis and insights on top of it. You can even create a community for discussion. And you can use more eye-catching mediums like videos to take your engagement to the next level.

Building trust with transparency

Trust is the cornerstone of any financial relationship. And content marketing is pivotal in building that with your audience.

To demonstrate honesty, be open with your customers about pricing, product offerings, and compliance. Case studies, customer testimonials, and behind-the-scenes content are all great ways to do this. It shows your clients that being honest with them is your top priority.

Utilizing a multi-channel approach

In today’s world, consumers are everywhere.

They’re on social media, in email inboxes, and listening to podcasts (just to name a few). If you want to maximize your company’s reach and ROI, you need a multi-channel approach. Multiple channels give you numerous touch points to attract and guide your audience through their customer journey.

But when you use this approach, having a high-quality content marketing strategy is crucial. Doing so ensures all your content works together to serve your brand’s overall mission and goals. It also ensures each channel properly reflects your brand’s message and voice.

Compliance and regulation-friendly content

Finance is one of the most heavily regulated industries in content marketing. Each piece of content must adhere to strict regulations set by financial authorities.

Now, following those regulations can feel restrictive and frustrating. But, it’s actually an opportunity.

Compliance exists to protect the consumers and businesses you’re trying to attract. Adhering to those regulations shows your commitment to prioritizing their safety. It shows your customers that you care and that they are in safe hands.

Ultimately, that adds to the trust you’re building in the other areas of your content marketing strategy.

Case Study: Success Story in Financial Content Marketing

Sometimes, the best way to learn is through real-life examples. Let’s examine a financial company that’s effectively leveraged content marketing.

Then, we’ll glean some insights you can apply to your own strategy.

PayPal: Harnessing financial storytelling

PayPal Newsroom stories campaign is a great example of effective financial content marketing. This section on their website showcases how PayPal connects and supports their customers. They take relevant and relatable financial topics and combine them with emotionally evocative storytelling.

Here are two great examples:

- World Refugee Day: Supporting the Economic Empowerment of Displaced People

- From Budgeting to Investing: These Experts Share Advice to Help You Navigate Your Finances

As you can see, they cover a range of targeted topics. Their economic empowerment article establishes them as a socially responsible brand.

Their next article does a fantastic job of touching on pain points while providing financial guidance. They bring an expert to discuss some of the most common struggles people go through. That establishes an immediate and powerful emotional connection with the target audience.

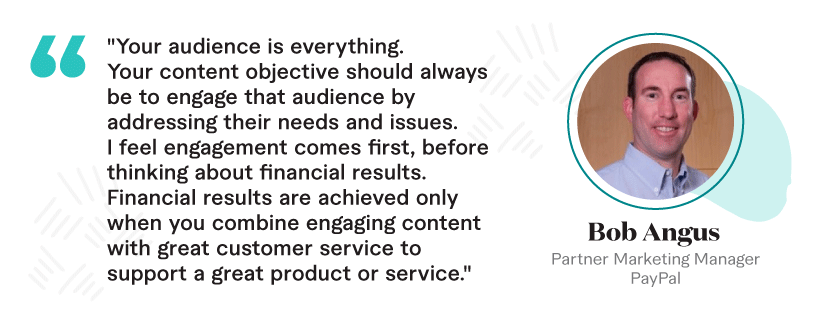

In an interview with Upland, PayPal’s Partner Marketing Manager Bob Angus puts it best:

“Your audience is everything. Your content objective should always be to engage that audience by addressing their needs and issues. I feel engagement comes first, before thinking about financial results. Financial results are achieved only when you combine engaging content with great customer service to support a great product or service.”

Overcoming Obstacles in Financial Content Marketing

Financial content marketing has its own unique set of obstacles. It can be easy to fall into a pitfall or two. Let’s break down some of the most common ones and how to overcome them.

Navigating compliance and regulations

Obstacle: Compliance is one of the biggest challenges faced in financial content marketing. At best, non-compliance means your content can’t get published. At worst, it means ruined relationships, tarnished reputations, and getting sued.

Solution: Build a compliance process for your content marketing strategy. Stay current on all FCA regulations and guidelines. Make sure to properly source all of your content. Last but not least, regularly review your old content so it adheres to any new regulations.

Breaking down complex financial concepts

Obstacle: Finance is full of complex jargon and concepts. It can feel overwhelming for many of your consumers to understand them all. That overwhelm leads to uncertainty, making them less likely to convert into sales. And no one wants scared customers.

Solution: Break down concepts into digestible, understandable information. It’s a perfect opportunity to educate and guide your audience. It establishes a dynamic with them that puts you in the thought leadership role. Infographics, animations, and explainer videos are all effective ways to do this. Remember, your goal is to empower your audience with knowledge, not overwhelm them with industry jargon.

Consistent brand messaging

Obstacle: In today’s marketing landscape, multi-channel content is paramount. But, maintaining a consistent brand message across all your channels can be challenging. Disparate messaging confuses your audience and dilutes your brand’s identity. And if your content isn’t working together across platforms, you lose a valuable resource to guide your customers into conversions.

Solution: Craft a well-defined brand guideline. That guideline is your touchstone for all content. It helps maintain a consistent tone of voice, visual style, and core message across all content and platforms. Additionally, do regular team training and review the guidelines to ensure everyone understands and adheres to them.

The Future of Financial Content Marketing

As the digital landscape evolves, so does the world of financial content marketing. You must continually adapt your content strategy to parallel those shifts to stay ahead of the curve.

That means:

- Investing and experimenting with new technology.

- Leveling up your team with new relevant skills.

- Updating your content strategy to align with changing consumer behaviors.

Anticipating new trends means staying at the forefront of your industry and keeping an edge over the competition. It’ll also help you plan financial content ideas that will be the most effective and relevant to your audience. So let’s look at what the future holds for financial content marketing.

Predicted trends and developments

Here are some of the top trends to watch out for:

AI: AI in content marketing is just getting started. Using AI and Blockchain in finance can be a fantastic support to marketing campaigns. It analyzes massive amounts of data at superhuman speeds and can automate low-level tasks. That frees up us humans to concentrate on higher-level work. More than 80 percent of industry experts already use AI technology in their marketing activities. With those numbers, investigating if AI can be a helpful addition to your company is critical.

Personalized Content: Personalization is another huge one. 72 percent of customers consider personalization crucial in finance. 78 percent perceive a relationship between themselves and a company using custom content to connect with them. Consumers’ expectations are only accelerating. And they want to feel like they are making their purchases organically. Expertly crafted personalized content can be your lynchpin in reeling them in without sacrificing trust.

Data and Analytics: Providing a personalized experience requires knowing your customers’ behavior and patterns. That’s where data comes in. Data helps create informed marketing campaigns that maximize your reach and ROI. Plus, it can work with AI to make predictions about customer buying patterns.

Multi-Channel Marketing: Multi-channel marketing is a great way to execute personalized experiences. Customers are all over the place across numerous platforms. Right now is the perfect time to engage with them in unique ways. 95 percent of marketers say multi-channel marketing is important to their content strategies. And, 87 percent of senior-level marketers agree that a customer journey across multiple channels is critical.

Next Steps in Your Financial Content Marketing Journey

The financial world is full of opportunities for growth and connection with your target audience. But, leveraging these opportunities requires unique and innovative strategies.

When it comes to strategies, sometimes the best way to maximize your marketing impact is by creating a high-performing finance content marketing team through outsourcing. That’s where we come in.

At ClearVoice, our managed content creation team can provide comprehensive financial content marketing solutions tailored to your brand’s unique needs and goals.

Talk to a specialist today to learn how we can take your financial content marketing strategy to the next level.