What is a customer acquisition cost (CAC)?

Customer acquisition cost is how much you spend to gain a single customer during a specific campaign or timeframe. It is a metric that helps businesses measure the effectiveness and efficiency of their content marketing campaigns in generating new customers.

As a company, CAC is useful because it tracks one customer’s monetary value, shedding light on areas where your business can bring more value and get customers to buy more. Investors use the figure to gauge your company’s profitability by comparing how much your customers spend on your products and services to how much it costs to win them over. Knowing your CAC also shows what parts of your sales and marketing processes are most effective so that you can double down on the channels bringing the most results for the lowest cost.

CAC considers the total costs associated with acquiring customers, including content creation, distribution, promotion, advertising, and any other expenses incurred during the customer acquisition process. These costs are divided by the number of customers acquired within a specific time period to calculate the CAC.

Why is tracking your CAC so important?

Your business stays in business by being financially efficient. Just like tracking your total customer value (TCV), by tracking your CAC, you gain insights into how much you spend to bring in new business and whether those costs are reasonable and sustainable. Measuring customer acquisition costs allows you to identify inefficiencies, cost-saving opportunities, and potential areas for improvement in your content marketing strategy.

Once you know your financial inefficiencies, you have clear data points to allocate your budget properly. CAC enables you to strategically determine the appropriate level of investment in each content marketing activity and campaign.

After properly allocating your budget, you can use CAC to scale and grow your business. By understanding the costs and resources required to acquire new customers, you can properly plan for future growth by setting realistic growth targets and identifying opportunities for optimization.

How do you calculate customer acquisition costs?

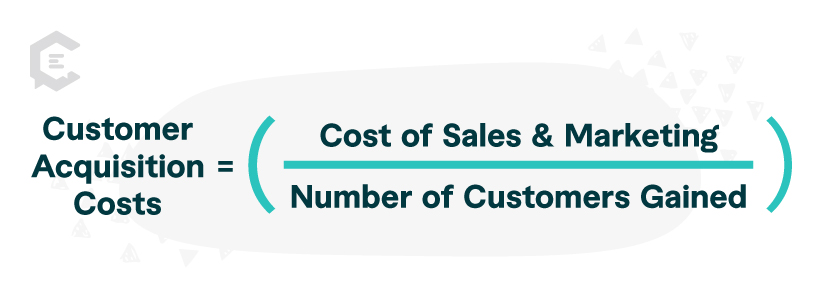

All you need to calculate your CAC is a straightforward formula:

The formula for calculating CAC is:

CAC = CSM / CG

CSM is your “Cost of Sales & Marketing,” and CG is your “Number of Customers Gained.” Say you spent $100,000 on your sales and marketing efforts for a campaign that drew in 1,000 new customers.

Your CAC would be $1,000 per customer acquired [$100,000 / 1,000 customers = $1,000].

By comparing the CAC to a customer’s lifetime value (LTV), businesses can determine whether their content marketing efforts are generating a positive ROI. Ideally, a lower CAC indicates that a company is acquiring customers at a more efficient cost. A higher CAC may indicate the need for optimization or adjustments in the content marketing strategy.

What expenses are related to CAC?

CSM should be the total cost involved in your sales and marketing efforts. It can include expenses in sales and marketing departments for things like:

- Employee salaries

- Software and other tech-related costs

- Overhead costs

- Inventory upkeep for SaaS businesses

- Outsourced services

- Ad spending

- Publishing costs

- Production costs

What’s a good CAC?

You can use your customer acquisition cost to look at the profitability of a particular marketing campaign or time period. If your CAC is too high, it also allows your company to assess how to lower the CAC to acceptable levels.

Customer acquisition costs vary widely by industry, so a more useful measure to judge where your CAC stands is to compare it to your customer’s lifetime value (LTV). LTV is how much revenue you predict a single customer will bring over their relationship with you. To find the LTV, you’ll want to multiply three figures:

The average value of a purchase x average number of transactions x length of the relationship = LTV

If the average sale at your company is $200, and customers buy from you four times per year for two years before moving on, your LTV is $1,600 [$200 x 4 x 2].

In general, your LTV and CAC ratio should be about 3:1. This means that your customer generates three times more value than the cost to acquire them.

If your ratio is 5:1, you may spend too little on gaining new customers and losing business opportunities. If it’s 1:1, then you’re only breaking even between what you and your customers are spending.

Three Ways to Lower Your Customer Acquisition Cost

If your customer acquisition cost is coming out too high, some of the best ways to reduce it are:

- Boost your website conversion rates. Better sales copy, landing pages, calls-to-action, and mobile experiences can optimize customer acquisition efforts while getting customers to spend more.

- Raise the value of current clients. Introducing new products, services, upgrades, and packages can increase your customer’s lifetime value.

- Improve your content marketing. Online content is a marketing powerhouse that can live on indefinitely. Effective content establishes you as an authority in your industry and as a helpful resource for your target audience while simultaneously organically growing your reach. Content CAC ratios are as much as 30 percent better than paid CAC.

To get help creating effective strategies to reduce your CAC, contact a content specialist at ClearVoice about your needs today.